Description

About Authorize Accounts/Why should you need to buy an authorize.net account?

Authorize.Net is among the most popular and earliest payment gateways for eCommerce. CyberSource purchased Authorize.Net at the end of 2007. Additionally, CyberSource was, consequently purchased by Visa this year. CyberSource has provided services to payment gateways to more 400 million merchants since its inception.

Before we dive into the various aspects of Authorize.Net’s offerings, let’s dispel a common mistake: Authorize.Net is currently perhaps not a merchant account provider. It is the payment gateway, as well as lots of additional products and services that integrate it with. It can create merchant accounts in the event you don’t already have one, then it is a third party chip that gives that option.

You can find an online payment processor in Authorize.Net with just one of two ways. First you can join in conjunction with Authorize.Net. This is great in the event that you already own a credit card with the service of a company; it might not always require an affiliation with Authorize.Net. Additionally, you can get a merchant account from various merchant account companies that cooperate together with Authorize.Net.

There are many of these, such as, Payment Depot and CDGcommerce (browse our reviews ) are among the most highly rated companies. Which one is best for you could be contingent on the size and type of your company as well as the merchant account services you already have.

For the majority of retailers, getting an Authorize.Net access through their current merchant account service provider will in the near future more affordable, since the majority of providers will waive the fee for installments to the gateway and will also offer lower monthly entry fees.

Read More:Buy Verified Payoneer Account

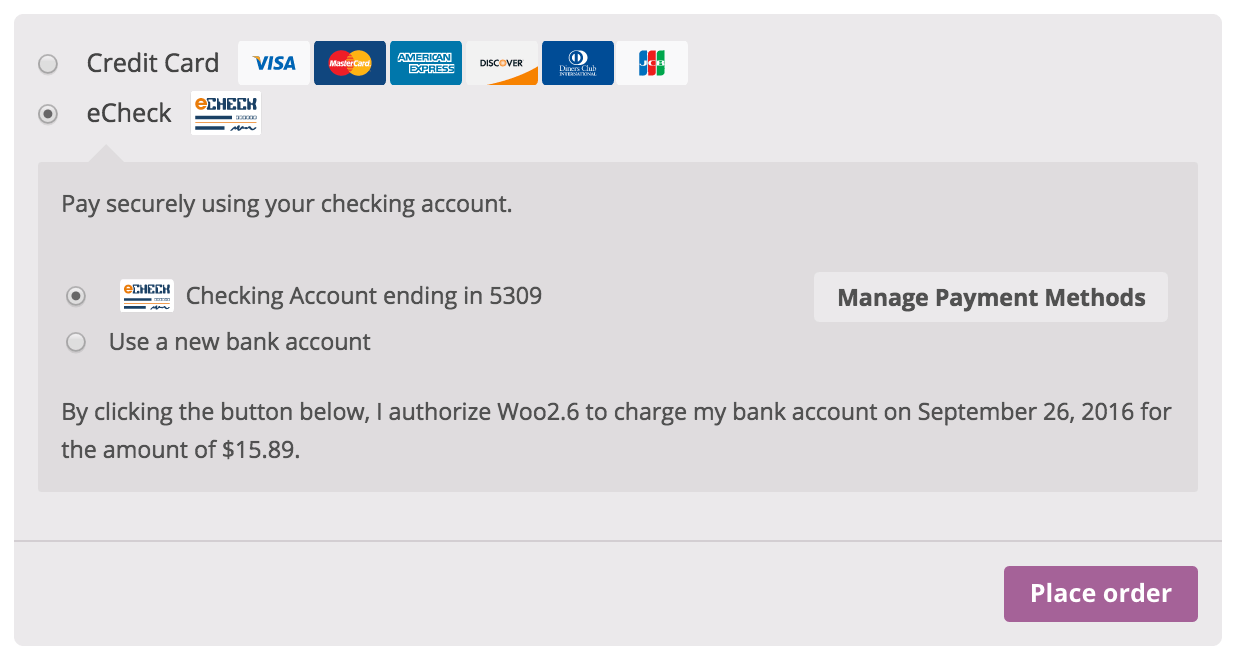

However you get your payment processor, Authorize.Net gives trustworthy support. Alongside a basic payment processor, you’re going to be able to access an automated fraud detection feature, a simplified checkout process, service for automatic billing and a person’s information director and QuickBooks support — all for absolutely no cost. E-check processing could be designed to be low-cost cost.

It is possible to turn your PC into virtual terminals through Authorize.Net’s Free electronic Point of Sale (VPOS) computer software , as well as an connected card reader via USB. The card reader choices today include an EMV-compliant version. Although it’s expensive, it’s a worthwhile investment should you try to sell your product online and through a retail website.

Its service is efficient and provides a wide range of features that make it more than just a way to accept credit cards over the internet. It also offers excellent customer service and support.

The Chase bank representative offered it on the market for anyone should we want to find a fresh method of processing bank cards. It may have different capabilities, but accepting credit card payments might be the only feature of the site people use.

It’s also a bit complicated and possibly the most unique user-friendly choice I’ve ever had. The money does end at our accounts.

You are able to tailor precisely the email notifications you receive in relation to individual trades as well as at the final day.

I doubt that any among those programmers has ever employed it.

The information about your credit card that the application requests can be a challenge as it doesn’t request for the usual advice however it will not ask for many other questions that are not normally needed. This could be just a simple matter of security and could be a nuisance rather than a problem.

It’s unlikely to work for a POS because it typically takes too long to type into each customer’s billing information, first-born blood type, the the maiden name of your neighbor’s mom’s next-door neighbor’s neighbor. .okay The last three aren’t needed. But, it definitely seems like that’s the amount of information it demands every second. :

- Wide support for a variety of money sources

- Robust safety and anti Fraud features

- Month-to month charges

- No long-term contracts

Cons

- The all-purpose option could confuse the customers.

- High Flatrate Pricing for merchant accounts that are elective

- It could be cheaper to use Authorize.Net when bundled with other services.

Reviews

There are no reviews yet.